Honored to

support

small business

If you have worked with us and have questions please email us at info@integratedrefunds.com, or call 888-517-3386.

Up to 80% of U.S.

Businesses Qualify

Qualify Even if You

Received a PPP Loan

What you need to know about ERC

Employee Retention Credit (ERC) is a payroll tax refund introduced with the CARES Act in March 2020.

Designed to incentivize employee retention through Covid-19, the IRS estimates up to 80% of U.S. businesses are eligible for ERC even if they’ve received a PPP loan.

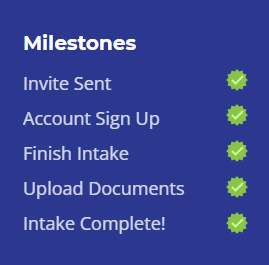

Claiming your ERC refund is as

Easy as 1, 2, 3!

— You don’t owe us a nickel until you get paid!

1. Check eligibility

Complete our easy ERC Qualification form in just a few minutes!

2. Prepare claim

Submit documents through our Secure Portal. We’ll analyze, calculate, & document your Maximum Refund.

3. Get paid

Sign & submit your claim to the IRS and receive your check in the mail.

Why Integrated Refunds?

Our team secures refunds that

average over $200,000!

Check out how our team has helped businesses across these industries and many more.

Food, Beverage & Hospitality

$

0

+

Million

Personal Services

$

0

+

Million

Recreation & Fitness

$

0

+

Million

Early Education & Day Care

$

0

+

Million

Non-Profit

$

0

+

Million

$

0

REFUND

“They made the process so simple … Call them today!”

$

0

REFUND

“We’re so thankful we found Integrated Refunds … our ERC money will be put to good use.”

Reclaim what's yours

Integrated Refunds is your partner in reclaiming what you’ve earned. Our integrated team of tax refund professionals aims to strengthen American Business one client at a time. We’re Your ERC Experts!